Ethical lender Triodos raises over £7m on its crowdfunding site

ETHICAL lender and investor Triodos Bank has successfully raised over £7m on its crowdfunding platform.

The company, which only lends money to businesses deemed to be making a positive, social and cultural impact, launched its Triodos Crowdfunding brand in January.

“Since launching the crowdfunding platform, we have seen significant interest among investors looking to support pioneering, sustainable organisations and businesses,” said Dan Hird, head of corporate finance at Triodos Bank.

“The range of projects that have already been or are near to being funded is evidence of the potential of crowdfunding to prompt positive social, environmental and cultural change.

Read more: Final outstanding P2P loan on Trillion Fund gets paid off

“We are proud to be at the forefront of this movement and aim to support the funding of many more progressive projects on the Triodos Crowdfunding site.”

Triodos currently has four bond offers live on the platform, with interest rates ranging from five to seven per cent. The minimum investment can be as low as £100 and it is possible to hold all of the projects in an Innovative Finance ISA (IFISA) wrapper.

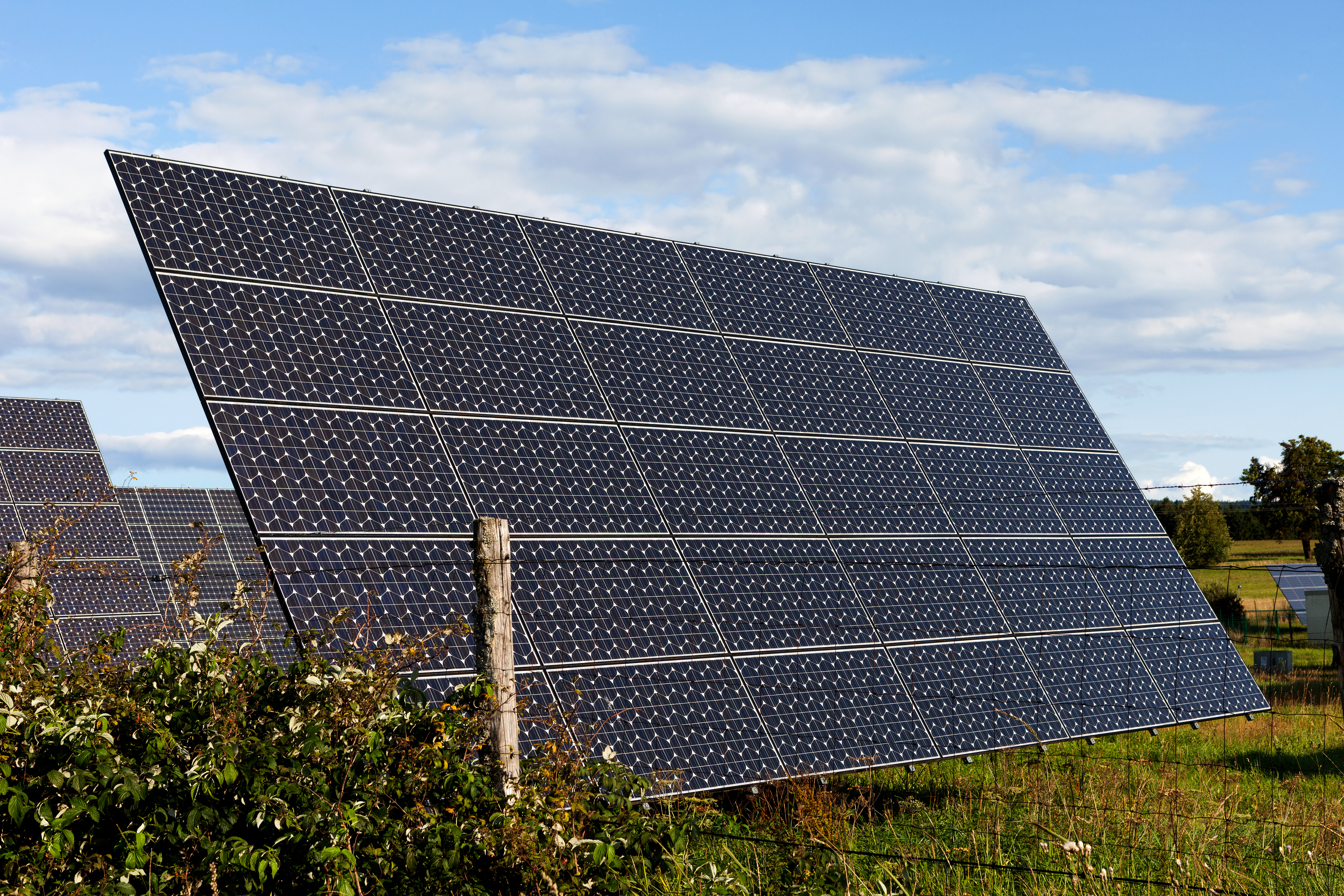

The latest offer to be successfully completed on the site was a £1.8m bond for Mendip Renewables, which will take a five-megawatt operational solar farm in Somerset into community ownership.

Read more: Ultimate guide to Innovative Finance ISAs: Part five